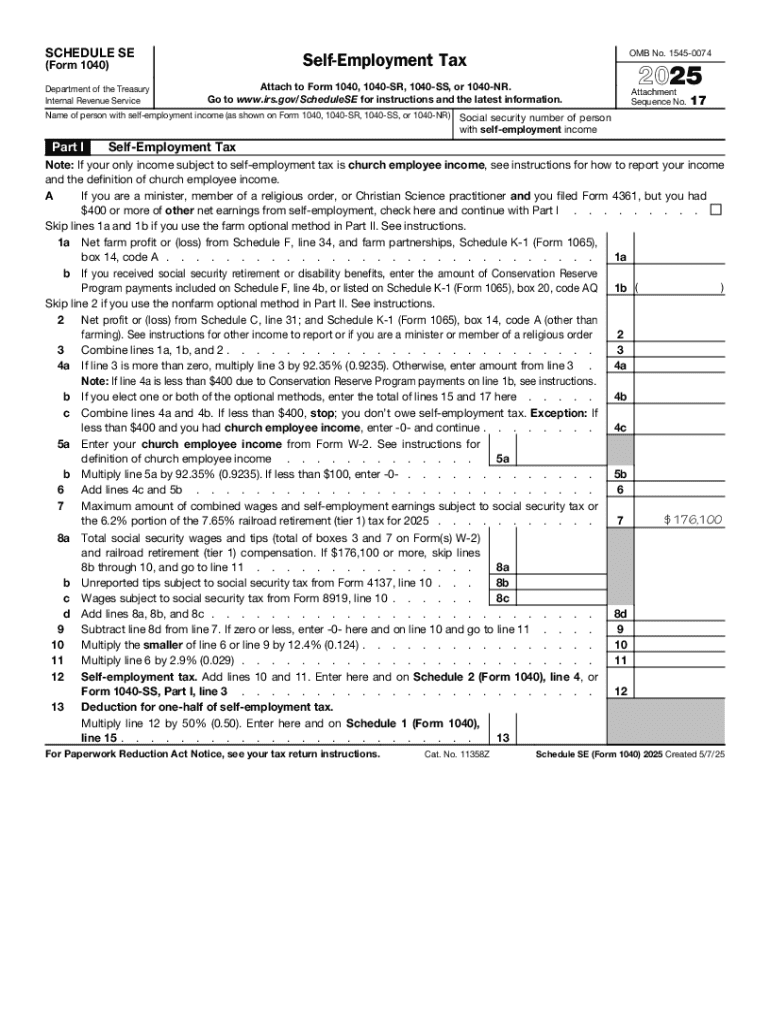

IRS 1040 - Schedule SE 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

Latest updates to IRS 1040 - Schedule SE

All You Need to Know About IRS 1040 - Schedule SE

What is IRS 1040 - Schedule SE?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule SE

What should I do if I need to correct an error on my submitted IRS 1040 - Schedule SE?

If you discover an error after submitting your IRS 1040 - Schedule SE, you should file an amended return using Form 1040-X. This form allows you to make corrections to the original return. Include any necessary documentation that supports the changes you're making to ensure accurate processing.

How can I check the status of my IRS 1040 - Schedule SE filing?

To check the status of your IRS 1040 - Schedule SE, you can use the IRS's online tool for tracking your return. This tool provides updates on whether the IRS has received your submission and its processing status. Ensure to have your personal information on hand for verification purposes.

What should I do if I receive a notice from the IRS regarding my IRS 1040 - Schedule SE?

If you receive a notice or letter from the IRS concerning your IRS 1040 - Schedule SE, carefully read the document and follow the instructions provided. It may require you to respond with additional information or clarify discrepancies. Keep copies of all correspondence for your records.

Are there common mistakes I should watch out for when filing IRS 1040 - Schedule SE?

Yes, common mistakes when filing the IRS 1040 - Schedule SE include incorrect calculations of self-employment tax and failing to report all income. It's vital to double-check your entries and ensure all income sources are accurately included to avoid delays or rejections.

What are some legal considerations when filing IRS 1040 - Schedule SE on behalf of someone else?

When filing the IRS 1040 - Schedule SE on behalf of someone else, ensure you have the proper authorization, such as a Power of Attorney (POA). Additionally, be aware of privacy laws and keep their financial information secure throughout the filing process.

See what our users say